Thank you!

Artists

-

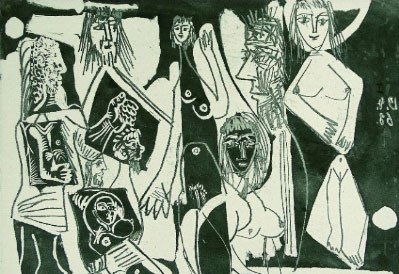

Batman

Mimmo Rotella£1,334.08 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 100 cm

-

Marilyn Monroe - Orange On Pink 11.22

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Marilyn Monroe-Pink On Green 11.23

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Marilyn Monroe-Gray 11.24

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Marilyn Monroe-Green 11.25

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Marilyn Monroe-Blonde On Gray 11.26

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Marilyn Monroe - Blonde On Pink 11.27

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Marilyn Monroe-Yellow//Blue On Pink 11.28

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Marilyn Monroe-Purple On Blue 11.29

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Marilyn Monroe-Pink On Blue 11.30

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Flowers Purple/Green 11.64

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Flowers - Yellow/Purple/Red On Blue 11.65

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Flowers - Red/Orange/Yellow On Purple 11.66

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Flowers-Orange/Yellow/Purple 11.67

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Flowers - Pink/Yellow On Green 11.68

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Flowers - Blue On Orange 11.69

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Flowers - Yellow/Gold/Blue On Pink 11.70

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Flowers - Yellow/Red On Blue 11.71

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Flowers II.72

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Flowers - Red/Purple/Yellow On Green 11.73

Andy Warhol£560.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

91 cm x 91 cm

-

Mao - Grey

Andy Warhol£478.41 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

75 cm x 90 cm

-

Mao - Silver

Andy Warhol£478.41 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

75 cm x 90 cm

-

Mao - Pink

Andy Warhol£478.41 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

75 cm x 90 cm

-

Mao - Red

Andy Warhol£478.41 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

75 cm x 90 cm

-

Mao - Yellow

Andy Warhol£478.41 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

75 cm x 90 cm

-

Dollar

Andy Warhol£492.08 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

43 cm x 49 cm

-

Dollar

Andy Warhol£492.08 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

43 cm x 49 cm

-

Dollar

Andy Warhol£492.08 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

43 cm x 49 cm

-

Dollar

Andy Warhol£492.08 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

43 cm x 49 cm

-

Fruit Basket - Gold

Tomoko Nagao£1,981.98 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

145 x 96

-

Nativity (big)

Tomoko Nagao£608.26 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

100 x 70

-

Nativity (small)

Tomoko Nagao£471.57 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 50 cm

-

Princess Candy (small)

Tomoko Nagao£471.57 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 50 cm

-

Princess Candy (big)

Tomoko Nagao£608.26 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

100 x 70

-

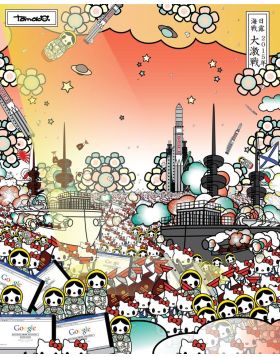

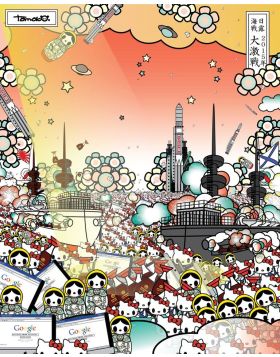

Tokyo Super Hero (small)

Tomoko Nagao£471.57 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 50 cm

-

Tokyo Super Hero (big)

Tomoko Nagao£608.26 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

100 cm x 70 cm

-

Venus with Pasta (small)

Tomoko Nagao£471.57 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 50 cm

-

Venus with Pasta (big)

Tomoko Nagao£608.26 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

100 x 70

-

Young sick Bacchus with still life (small)

Tomoko Nagao£471.57 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 50 cm

-

Young Sick Bacchus with still life (big)

Tomoko Nagao£608.26 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

100 cm x 70 cm

-

Salomè Gemini

Tomoko Nagao£1,435.23 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

33 x 30

-

-

Peal Star Green Hair

Tomoko Nagao£1,435.23 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

33 x 30

-

Gritter Stars Pink Ribon

Tomoko Nagao£1,435.23 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

33 x 30

-

Pedal Sutra

Matteo Guarnaccia£269.96 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

100 cm x 70 cm

-

Watermelon Sutra

Matteo Guarnaccia£269.96 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

100 cm x 70 cm

-

-

Seal

Marco Lodola£246.04 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 50 cm

-

Elephant

Marco Lodola£246.04 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 50 cm

-

Horse

Marco Lodola£246.04 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 50 cm

-

Lion

Marco Lodola£246.04 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 50 cm

-

Tiger

Marco Lodola£246.04 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 50 cm

-

-

-

-

La Pietà

Mr. Savethewall£269.96 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

60 cm x 60 cm

-

Superman

Marco Lodola£218.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 40 cm

-

Batman

Marco Lodola£218.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 40 cm

-

-

Fruit Basket after Caravaggio

Tomoko Nagao£1,667.60 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64 cm x 36

-

-

-

Salomè Bali Magenta

Tomoko Nagao£1,435.23 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

33 x 30

-

-

-

King Me

Mr. Savethewall£198.20 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

31 cm x 43 cm

-

Frankenstein

Mr. Brainwash£0.00 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

111,5 cm x 91,5 cm

-

-

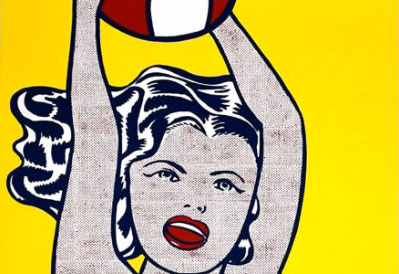

Lichtenstein (First Edition)

Mr. Brainwash£0.00 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

76 cm x 56 cm

-

-

Batman - Screenprint

Marco Lodola£116.19 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

21 cm x 29,5 cm

-

Porsche Silver - Screenprint

Marco Lodola£116.19 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

21 cm x 29,5 cm

-

Il volto degli Altri - Screenprint

Marco Lodola£116.19 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

21 cm x 29,5 cm

-

Superman - Screenprint

Marco Lodola£116.19 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

21 cm x 29,5 cm

-

-

-

-

-

-

-

-

-

-

Niji Dojo-Iri, Size XS

Arnaud Nazare-Aga£218.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

13 cm x 13 cm

-

Toroki Red Shiko, Size XS

Arnaud Nazare-Aga£218.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

15 cm x 15 cm

-

Toroki White Welcome, Size XS

Arnaud Nazare-Aga£218.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

13 cm x 16 cm

-

Toroki White Dojo-Iri, Size S

Arnaud Nazare-Aga£505.75 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 22,5 cm

-

-

-

-

Kozu Welcome, Size XS

Arnaud Nazare-Aga£218.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

15 cm x 15 cm

-

Sumorai Dojo-Iri, Size S

Arnaud Nazare-Aga£505.75 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 22,5 cm

-

-

-

-

-

Ikashi Shiko, Size XS

Arnaud Nazare-Aga£218.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

15 cm x 15 cm

-

Otsu Shiko, Size XS

Arnaud Nazare-Aga£218.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

15 cm x 15 cm

-

Chichi Shiko, Size XS

Arnaud Nazare-Aga£218.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

15 cm x 15 cm

-

Iwo Shiko, Size XS

Arnaud Nazare-Aga£218.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

15 cm x 15 cm

Register

Register Wishlist

Wishlist Contact Us

Contact Us