Thank you!

Artists

-

-

Creation

Mr. Brainwash£0.00 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25,4 cm x 25,4 cm

-

Fragile Heart

Mr. Brainwash£0.00 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25,4 cm x 25,4 cm

-

-

-

-

-

-

-

-

-

-

-

-

-

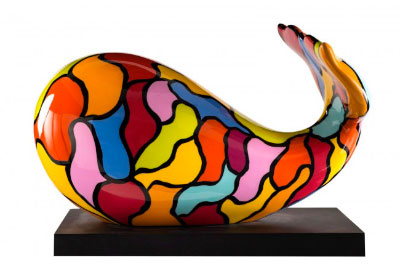

Bootie - Hippop Art, Size M

Arnaud Nazare-Aga£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 24 cm

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Cheek to cheek

Romero Britto£1,339.07 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40,5 cm x 50 cm

-

-

Dylan's Candy Bar

Romero Britto£810.31 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

76 cm x 101 cm

-

-

Royalty - Limited Edition Sculpture

Romero Britto£446.36 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

21 cm x 22 cm

-

-

-

-

-

-

-

Life Is Beautiful - Dipped Black

Mr. Brainwash£1,648.09 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

26.7 x 19.1

-

Life Is Beautiful - Dipped Bubblegum

Mr. Brainwash£1,648.09 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

26.7 cm x 19.1 cm

-

-

-

-

-

-

Mon Nono - Hippop Art, Size M

Arnaud Nazare-Aga£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 26 cm

-

Doudou - Hippop Art, Size M

Arnaud Nazare-Aga£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 26 cm

-

Don't Worry - Hippop Art, Size M

Arnaud Nazare-Aga£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 26 cm

-

-

-

-

-

Smile (Half) - Yellow

Mr. Brainwash£240.34 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

6.3 x 19.1

-

Work Well Together - Cyan

Mr. Brainwash£240.34 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

6.3 x 19.1

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Coppia in Vespa (Light Sculpture)

Marco Lodola -

-

-

-

-

-

-

-

Register

Register Wishlist

Wishlist Contact Us

Contact Us