Thank you!

Artists

-

-

Burnt iron n°72

Bernard Aubertin£1,648.09 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30 x 49

-

Burnt iron n° 228

Bernard Aubertin£1,648.09 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

49 x 30

-

Burnt iron n°233

Bernard Aubertin£1,648.09 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30 x 49

-

Burnt iron n°208

Bernard Aubertin£1,648.09 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30 x 49

-

Burnt iron n°174

Bernard Aubertin£1,648.09 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30 x 49

-

Olympische Spiele Munchen 1972-R. B. Kitaj

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64.5 x 101

-

Olympische Spiele Munchen 1972-Paul Wunderlich

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64.5 x 101

-

Olympische Spiele Munchen 1972-Lapicque Charles

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64.5 x 101

-

Olympische Spiele Munchen 1972 - Piero Dorazio

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64.5 x 101

-

Olympische Spiele Munchen 1972-Horst Antes

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64.5 x 101

-

Olympische Spiele Munchen 1972-Shusaku Arakawa

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64.5 x 101

-

Batman - Grittini

Giuliano Grittini£1,005.34 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

B. B.

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Queen

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Jimi Hendrix - Grittini

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

David Bowie - Grittini

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

The Beatles - Grittini

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Belle Ferronnière

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Snow baby

Chiari Giuseppe£586.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 x 50

-

Belle Ferronnière

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Duran Duran

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Leonardo Da Vinci's Horse

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Burnt iron n°44

Bernard Aubertin£1,648.09 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30 x 49

-

Red Cardboard n°211

Bernard Aubertin£961.39 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

36 x 50

-

-

-

-

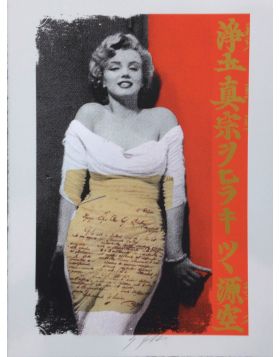

Marilyn the immortal

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 65

-

-

-

-

Guitar - Chiari

Chiari Giuseppe£1,675.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Abstrakte Realitaten

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64 x 82

-

-

-

Red Cardboard n°175

Bernard Aubertin£961.39 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

36 x 50

-

Red cardboard n°153

Bernard Aubertin£961.39 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

36 x 50

-

Red Cardboard n°154

Bernard Aubertin£961.39 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

36 x 50

-

Red Cardboard n°180

Bernard Aubertin£961.39 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

36 x 50

-

Olympische readymade polaroid-Otl Aicher

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64,5 x 101

-

Olympische readymade polaroid-Hartung Hans

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64,5 x 101

-

Olympische readymade polaroid-Allan d'Arcangelo

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64,5 x 101

-

Olympische Spiele Munchen 1972-Pierre Soulages

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64,5 x 101

-

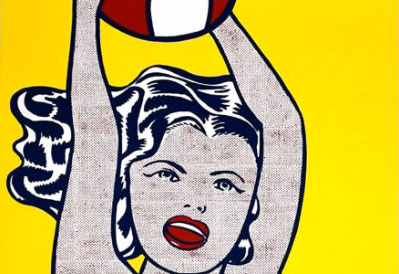

Olympische Spiele Munchen 1972-Otl Aicher e Tom Wesselmann

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64,5 x 101

-

Olympische Spiele Munchen 1972-Eduardo Chillida

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64,5 x 101

-

Olympische Spiele Munchen 1972-David Hockney

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64,5 x 101

-

Olympische Spiele Munchen 1972-Peter Phillips

Maurizio Galimberti£2,345.78 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

64,5 x 101

-

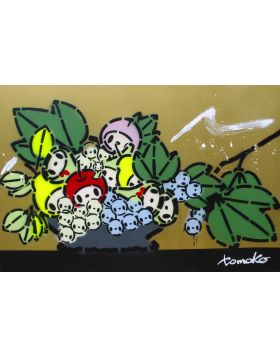

Fruit Basket - Gold

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

145 x 96

-

Marilyn Monroe d'argent

Giuliano Grittini£209.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 x 26

-

Orange Marilyn

Giuliano Grittini£209.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 x 26

-

Marilyn Monroe Love

Giuliano Grittini£209.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 x 26

-

Marilyn eternal beauty

Giuliano Grittini£209.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 x 26

-

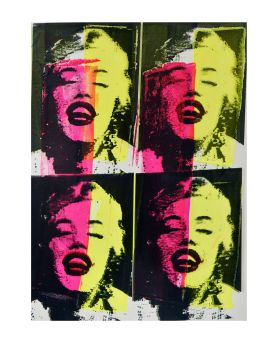

FIVE - Marilyn Monroe

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

FIVE - Marilyn Monroe

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

FIVE - Marilyn Monroe

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

FIVE - Marilyn Monroe

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

FIVE - Marilyn Monroe

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

Marilyn Monroe Beauty

Giuliano Grittini£4,188.90 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

Salomè Blue Bow

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

140 x 130

-

Chanel Shoes MicroPop SuperFlat Yellow

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

110 x 100

-

-

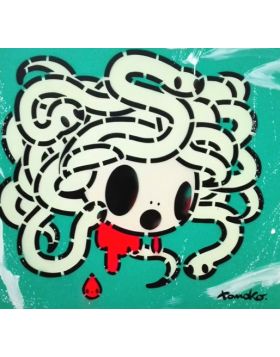

Medusa Acquamarine

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

110 cm x 100 cm

-

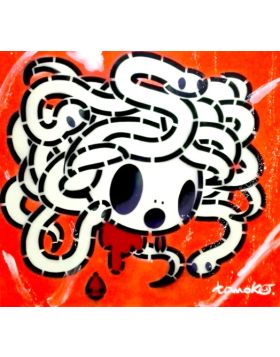

Medusa Purple

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

110 cm x 100 cm

-

Medusa red

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

110 cm x 100 cm

-

-

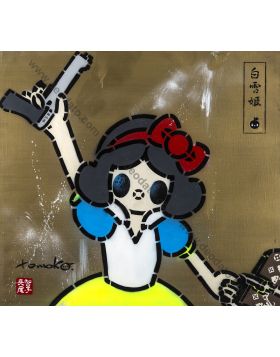

Snowhite Pastel color

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

110 cm x 100 cm

-

Salomè Yellow Bow

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

140 x 130

-

-

-

-

-

-

-

-

Snow White Red

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

110 cm x 100 cm

-

Snow White Light Blue

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

110 cm x 100 cm

-

-

-

-

La Pietà

Mr. Savethewall£271.25 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

60 cm x 60 cm

-

Bacchus Purple

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

130 cm x 120 cm

-

Gioconda Ribbon Yellow Flue

Tomoko Nagao£1,991.44 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

110 cm x 120 cm

-

-

-

Catharsis

Manuela Manes£2,197.46 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

120 x 100

-

Give Peace a Chance

Manuela Manes£1,373.41 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 70 cm

-

-

-

-

-

-

-

-

-

-

-

-

-

Register

Register Wishlist

Wishlist Contact Us

Contact Us