Thank you!

...other artists

-

-

INTERstellar

Mr. Savethewall£171.68 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 30 cm

-

-

Red Stars

Giampaolo Talani£58.37 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30cm x 30cm

-

A summer's day

Giampaolo Talani£58.37 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30cm x 30cm

-

Mickey & Minnie

Giuliano Grittini£240.34 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 cm x 30 cm

-

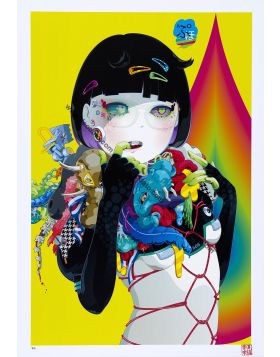

Tentacle Rape

Takahashi Hiroyuki£330.92 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 x 100

-

A Nice Guy

Takahashi Hiroyuki£216.31 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Shibari

Takahashi Hiroyuki£216.31 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Girl "shaman", Bull constellation

Takahashi Hiroyuki£271.25 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

100 x 70

-

-

-

Guitar - Chiari

Chiari Giuseppe£1,675.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Pedal Sutra

Matteo Guarnaccia£271.25 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

100 cm x 70 cm

-

Watermelon Sutra

Matteo Guarnaccia£271.25 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

100 cm x 70 cm

-

Sagittarius - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Cancer - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Two Shadows Together

Giampaolo Talani£58.37 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30cm x 30cm

-

Jimi Hendrix - Grittini

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

David Bowie - Grittini

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Duran Duran

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

-

-

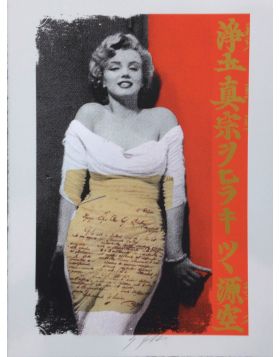

Marilyn the immortal

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 65

-

-

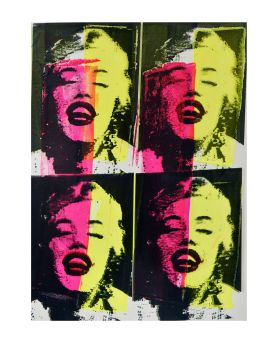

FIVE - Marilyn Monroe

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

FIVE - Marilyn Monroe

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

FIVE - Marilyn Monroe

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

Marilyn Monroe Beauty

Giuliano Grittini£4,188.90 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

Mickey Mouse

Giuliano Grittini£240.34 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 cm x 30 cm

-

Minnie

Giuliano Grittini£240.34 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 cm x 30 cm

-

Selfie_01

Maehashi Hitomi£402.13 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

33.3 cm x 33.3 cm

-

The fox

Takahashi Hiroyuki£271.25 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 x 100

-

-

Sailor girl against the monster

Takahashi Hiroyuki£330.92 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 x 100

-

Otomodachi (Friends)

Takahashi Hiroyuki£216.31 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 x 50

-

Cyber girl "shaman", Bull constellation

Takahashi Hiroyuki£216.31 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 x 50

-

The girl in swimsuit

Takahashi Hiroyuki£216.31 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Love you

Takahashi Hiroyuki£216.31 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

-

Sagittarius - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Pisces - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Scorpio - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Aries - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Sitting on books (Black)

Francesco Musante£125.66 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

20 x 50

-

Just two things (White)

Francesco Musante£92.70 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 x 20

-

This love so intense... Tribute to Jacques Prévert (Black)

Francesco Musante£133.91 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 x 25

-

This love so intense... Tribute to Jacques Prévert (White)

Francesco Musante£133.91 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 25 cm

-

The music fire up the night... Tribute to Jacques Prévert (White)

Francesco Musante£133.91 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 25 cm

-

Music fire up the night... Tribute to Jacques Prévert (Black)

Francesco Musante£133.91 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 25 cm

-

The secret library... Tribute to Jacques Prévert (Black)

Francesco Musante£133.91 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 x 70

-

Like an homeless... Tribute to Jacques Prévert (Black)

Francesco Musante£133.91 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 25 cm

-

L'informatico (Bianco)

Francesco Musante£82.40 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

20 cm x 23 cm

-

Boat

Giampaolo Talani£58.37 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30cm x 30cm

-

Serenade Sax

Giampaolo Talani£58.37 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30cm x 30cm

-

Traverse route

Giampaolo Talani£302.15 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

120 cm x 70 cm

-

Snow baby

Chiari Giuseppe£586.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 x 50

-

-

Omaggio a Haring

Ugo Nespolo£103.01 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 35 cm

-

Tribute to Warhol

Ugo Nespolo£103.01 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 35 cm

-

The Teacher (Black)

Francesco Musante£82.40 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

20 cm x 23 cm

-

Cancer - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Leo - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Virgo - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Scorpio - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Capricorn - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

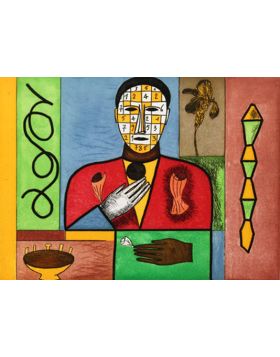

Mathematica (1)

Mimmo Paladino£1,424.23 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

77 cm x 57 cm

-

Mathematica (2)

Mimmo Paladino£1,424.23 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

77 cm x 57 cm

-

Mathematica (3)

Mimmo Paladino£1,424.23 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

77 cm x 57 cm

-

Mathematica (4)

Mimmo Paladino£1,424.23 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

77 cm x 57 cm

-

Acquarius - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Capricorn - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Virgo - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Leo - The Signs of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Gemini - The Signes of the Zodiac

Francesco Musante£72.11 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 25 cm

-

Batman - Grittini

Giuliano Grittini£1,005.34 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

B. B.

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Queen

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

The Beatles - Grittini

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Belle Ferronnière

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Belle Ferronnière

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

Leonardo Da Vinci's Horse

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 x 70

-

-

-

-

-

Red Marilyn

Giuliano Grittini£209.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

18 x 26

-

Marilyn Monroe d'argent

Giuliano Grittini£209.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 x 26

-

Orange Marilyn

Giuliano Grittini£209.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 x 26

-

Marilyn Monroe Love

Giuliano Grittini£209.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 x 26

-

Marilyn eternal beauty

Giuliano Grittini£209.45 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 x 26

-

FIVE - Marilyn Monroe

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

FIVE - Marilyn Monroe

Giuliano Grittini£921.56 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

52 x 72

-

-

-

Pinocchio (2)

Mimmo Paladino£1,466.12 VAT Margin (art. 36)VAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

45 cm x 60 cm

-

Hunters of shells

Giampaolo Talani£58.37 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30cm x 30cm

-

Traverse routes

Giampaolo Talani£58.37 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30cm x 30cm

-

Marine couple

Giampaolo Talani£58.37 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30cm x 30cm

-

Saint Lawrence Night

Giampaolo Talani£100.26 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40cm x 40cm

Register

Register Wishlist

Wishlist Contact Us

Contact Us