Thank you!

Daniele Fortuna

Daniele Fortuna: Art for Sale on Deodato Arte - Born in Milan, Daniele Fortuna is an artist and sculptor who has successfully combined Pop with classical forms, creating a bridge between past and present. His preferred material is wood painted with bright acrylic colors.

From sculptures with classical subjects such as Venus and Zeus to sculptures with Pop subjects such as Batman and Miky Mouse, Daniele Fortuna's best-known series include Colormination, Heads Will Roll and Thologiny.

-

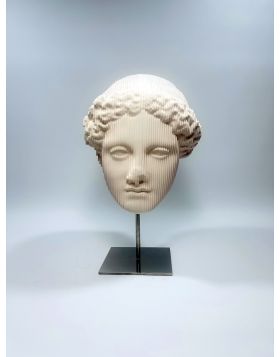

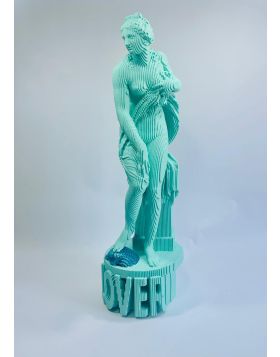

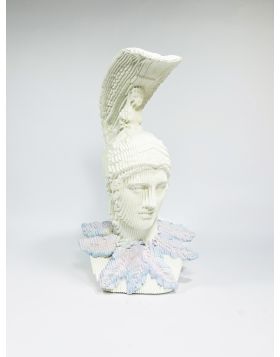

RIVA

Daniele Fortuna£1,441.86 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

18 cm x 60 cm

-

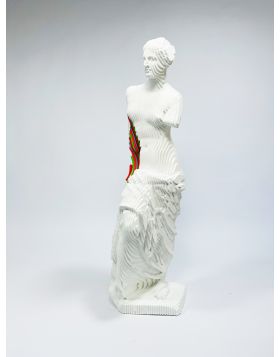

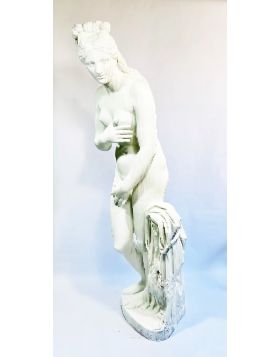

Venus Guerriera

Daniele Fortuna£1,167.22 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

22 cm x 35 cm

-

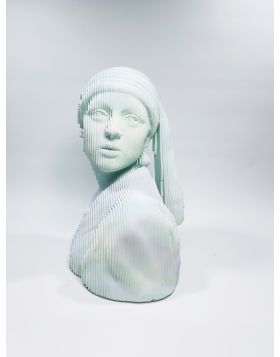

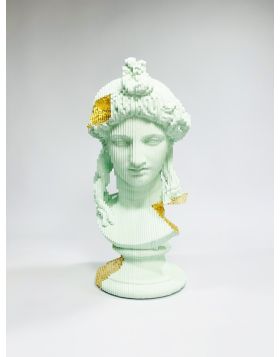

Remember Love

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

32 cm x 45 cm

-

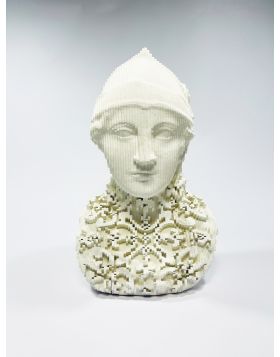

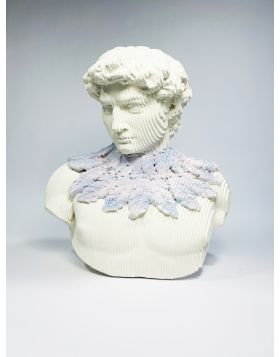

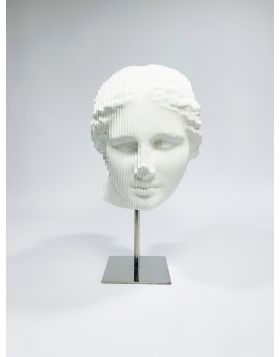

Allegory Delicate Shades

Daniele Fortuna£1,647.84 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 45 cm

-

Antinoo Mondrian

Daniele Fortuna£1,853.82 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

44 cm x 45 cm

-

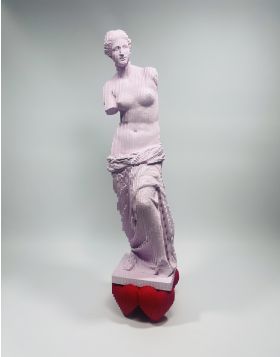

Venus Pink and Light Blue Shades

Daniele Fortuna£1,441.86 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30 cm x 45 cm

-

Thologiny (Ducks)

Daniele Fortuna£394.80 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 33 cm

-

Hero also love

Daniele Fortuna£1,785.16 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

34 cm x 50 cm

-

-

Riva

Daniele Fortuna£1,716.50 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

60 cm x 40 cm

-

Kusama Roll on the Floor

Daniele Fortuna£1,675.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

28 cm x 58 cm

-

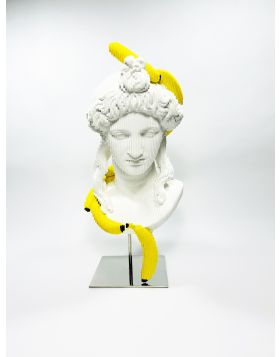

Bananas

Daniele Fortuna£1,675.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

31 cm x 55 cm

-

-

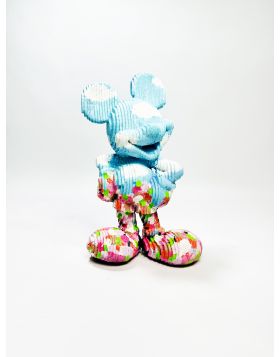

A spring day with clouds

Daniele Fortuna£920.04 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 cm x 30 cm

-

Venus Warhol

Daniele Fortuna£1,428.12 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

42 cm x 40 cm

-

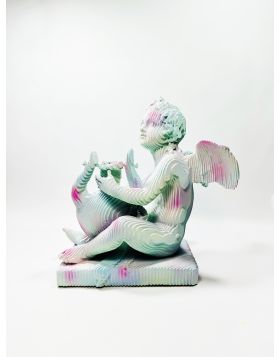

Cupido Delicate

Daniele Fortuna£1,757.69 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 cm x 45 cm

-

-

-

What the Gods Say (Love)

Daniele Fortuna£1,675.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

51 cm x 37 cm

-

What the Gods Say (Love Me)

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

37 cm x 36 cm

-

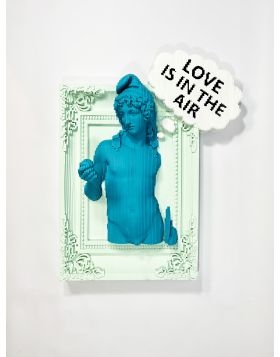

What the Gods Think (Love is in the Air)

Daniele Fortuna£1,991.14 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 65 cm

-

Blu Marte

Daniele Fortuna£1,215.28 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

20 cm x 30 cm

-

I love Kaws Blue

Daniele Fortuna£1,469.32 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

24 cm x 55 cm

-

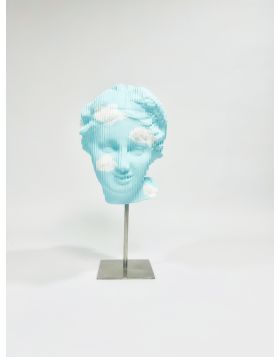

Venus Clouds

Daniele Fortuna£144.19 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 40 cm

-

Heads will Roll

Daniele Fortuna£144.19 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 40 cm

-

David Colormination

Daniele Fortuna£144.19 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 40 cm

-

Reborn

Daniele Fortuna£144.19 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 40 cm

-

Cupido Kissing Venus Colormination

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

34 cm x 42 cm

-

Antinoo Natural Gold

Daniele Fortuna£926.91 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

18 cm x 20 cm

-

Tuba

Daniele Fortuna£920.04 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 33 cm

-

Newton's apple

Daniele Fortuna£1,338.87 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

22 cm x 40 cm

-

Car Goldenmination

Daniele Fortuna£1,167.22 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

20 cm x 40 cm

-

Venus in my hand

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 cm x 42 cm

-

Time for victory

Daniele Fortuna£1,215.28 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

17 cm x 47 cm

-

Champagne in my hand

Daniele Fortuna£1,256.48 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

18 cm x 44 cm

-

Lady Murakami

Daniele Fortuna£1,853.82 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

27 cm x 45 cm

-

The boxer

Daniele Fortuna£1,167.22 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

22 cm x 32 cm

-

David & Baseball

Daniele Fortuna£1,050.49 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 32 cm

-

Heads will roll

Daniele Fortuna£961.24 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

12 cm x 36 cm

-

Venus Cassette

Daniele Fortuna£1,675.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 cm x 40 cm

-

Cocacola Venus

Daniele Fortuna£1,785.16 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

26 cm x 62 cm

-

Thologiny (Athena and Ice Cream)

Daniele Fortuna£394.80 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 33 cm

-

Thologiny (Candy)

Daniele Fortuna£394.80 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 33 cm

-

Thologiny (Hello Kitty)

Daniele Fortuna£394.80 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 33 cm

-

Thologiny (Pistacchio e Mirtillo)

Daniele Fortuna£394.80 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 33 cm

-

Thologiny (Stars Night)

Daniele Fortuna£394.80 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 33 cm

-

Thologiny (Sun on the Beach)

Daniele Fortuna£394.80 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 33 cm

-

Thologiny (Venus at the Beach)

Daniele Fortuna£394.80 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 33 cm

-

Anfitrite Clouds

Daniele Fortuna£926.91 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 20 cm

-

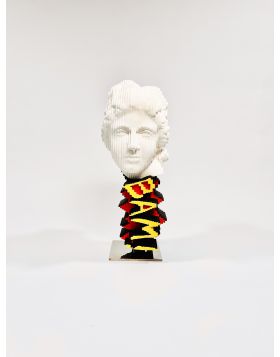

Thologiny (Bam)

Daniele Fortuna£394.80 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 33 cm

-

Colored Encrustations

Daniele Fortuna£1,380.07 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

21 cm x 29 cm

-

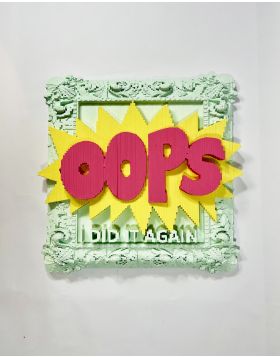

Oops I Did It Again

Daniele Fortuna£1,716.50 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

51 cm x 51 cm

-

Pow

Daniele Fortuna£1,592.91 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 45 cm

-

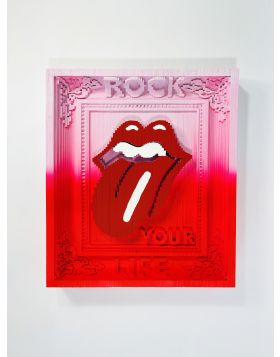

Rock Your Life

Daniele Fortuna£1,428.12 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 45 cm

-

Together Pink Palette

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 36 cm

-

Apollo Bust Delicate Shades

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30 cm x 48 cm

-

Pandora Vase

Daniele Fortuna£1,675.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 38 cm

-

Bacco Green

Daniele Fortuna£1,342.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

33 cm x 39 cm

-

-

I Love Mountains

Daniele Fortuna£1,256.48 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 cm x 42 cm

-

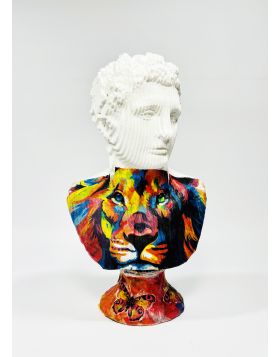

Like a Lion

Daniele Fortuna£1,338.87 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 cm x 44 cm

-

Street Bust

Daniele Fortuna£1,002.43 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 26 cm

-

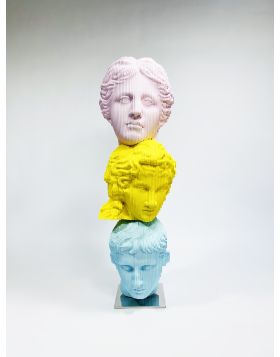

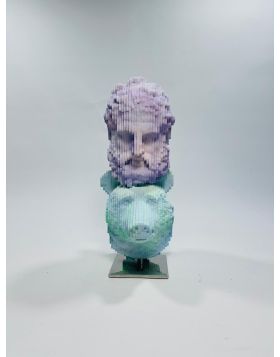

Heads will roll

Daniele Fortuna£1,853.82 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 cm x 70 cm

-

Penelope Rock N Roll

Daniele Fortuna£1,256.48 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 cm x 40 cm

-

-

-

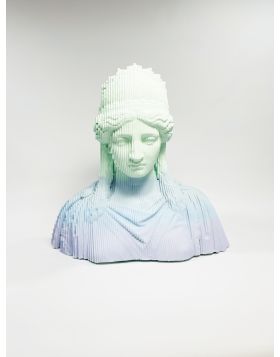

Delicate Shades

Daniele Fortuna£1,757.69 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

44 cm x 40 cm

-

Baroque Age (The Lady with Lion)

Daniele Fortuna£1,421.26 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

24 cm x 44 cm

-

Delicate Colormination

Daniele Fortuna£1,256.48 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

22 cm x 33 cm

-

Baroque Age (Athena Baroque)

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30 cm x 44 cm

-

-

Bear Beard

Daniele Fortuna£1,091.69 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

24 cm x 33 cm

-

Two flowers

Daniele Fortuna£1,338.87 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

27 cm x 28 cm

-

Hera Mirror

Daniele Fortuna£1,153.48 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

30 cm x 30 cm

-

Philosopher Mirror

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Batman Mirror

Daniele Fortuna£1,551.71 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

38 cm x 55 cm

-

Stand on Love

Daniele Fortuna£1,675.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

20 cm x 80 cm

-

-

Delicate Earring Pearl

Daniele Fortuna£1,675.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

41 cm x 43 cm

-

Diana in the Spring

Daniele Fortuna£1,675.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

42 cm x 42 cm

-

Radio Gaga

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

38 cm x 30 cm

-

I Feel Love

Daniele Fortuna£1,757.69 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

45 cm x 40 cm

-

Venus on the Wall (Delicate)

Daniele Fortuna£755.26 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 19 cm

-

Venus on the Wall (Violet)

Daniele Fortuna£755.26 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

16 cm x 19 cm

-

-

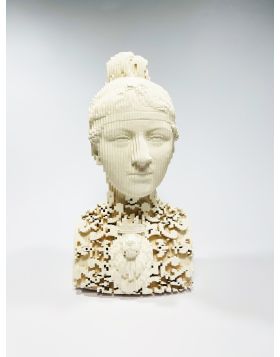

Baroque Age (opulent David)

Daniele Fortuna£1,853.82 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

44 cm x 46 cm

-

Venus Colormination

Daniele Fortuna£1,592.91 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

19 cm x 64 cm

-

Baroque Age (Marte)

Daniele Fortuna£1,675.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

31 cm x 51 cm

-

-

Apollo Goldenmination

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

22 cm x 47 cm

-

Paride Goldenmination

Daniele Fortuna£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

25 cm x 44 cm

-

Venus Cloudsmination

Daniele Fortuna£1,256.48 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

20 cm x 26 cm

-

Blue Sphinx

Daniele Fortuna£1,785.16 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

23 cm x 40 cm

-

-

-

-

-

-

-

Daniele Fortuna - Artist biography

Daniele Fortuna, artist born in Milan in 1981, since his early teenage, thanks to his passion for art, visited artist studios and art galleries among the most important of the city. He studied at the IED (European Institute of Design) in Milan, cultivating a strong interest in art and design.

He then moved for study and work in Ireland, in the south-east, near Dublin. There he worked in a lighting studio, where his interest in wood, the material that will be the foundation of his sculptures, was born. From the technique of carving, wood could in fact be composed in different shapes and patterns allowing the artist to give plastic shape to his ideas.

After finishing his studies in Ireland, he returned to Italy and began to create his first works. His art began to take shape and he created his first works in wood, paintings formed by wooden pieces shaped, coloured and then assembled like parts of a puzzle. Later he will move on to three-dimensional compositions, at first subjects from the animal world and then icons of the classical Greek-Roman combined with colours and traits of contemporary Pop.

Sculpture and colour in Daniele Fortuna artworks

From his parents' collection of paintings, Daniele Fortuna began to admire the materials they were made of and their proportions. He began to imagine the story behind those paintings and what had led the artist to their creation. Thus, an attraction was born for those objects, for their shapes and colours: the artist was attracted by De Chirico's timelessness, Sassu's inflamed red and Fontana's gestures.

Daniele Fortuna's sculptures are made of wood painted with acrylic paint, thus combining the plastic, material feature of wood with colour, a key element of the artist's aesthetic. Hence the word "colormination", a neologism that refers to the chromatic contamination of classical busts that occurs in his art. The word comes from "domination", a strong term, but combined with colour that renews its meaning.

And the colours that dominate range from pastel tones to fluorescent, metallic and even glittering shades; even works that at first glance seem white sometimes hide multi-coloured chasms.

Wood: a "living" material

Using the artist's own words:

"Wood was a material that I already felt was mine. I find it a 'warm' material because, when you touch it, you feel that it has that kind of porosity even though I paint it. And this being 'warm' represents me because I am a very convivial person, a person of companionship. Wood, then, is also alive because it expands and shrinks, it really has a life of its own."

But even though wood is his favourite material, Daniele Fortuna has also experimented with plexiglass, mirrors and concrete, combining art with his studies as designer.

A bridge between classical and contemporary Pop

Fortuna's sculptures have as their starting point classical subjects, Greco-Roman busts that are recreated in wood, with a technique that juxtaposes several staggered levels, almost recalling a digital reproduction.

In addition, a wide range of pop and contemporary iconography invades the works, drawing from the works of big names, such as Maurizio Cattelan and Takashi Murakami, to the logos of famous fashion designers; from world-famous brands to characters from cartoons, comics and films; from famous people, such as Albert Einstein, to references to the world of music, in particular that of Queen.

Combining bright and pop colours with classical shapes, he creates a bridge between past and present, bringing classic subjects back to their original form. Originally, in fact, the very statues of classicism were coloured but, for centuries, were mistakenly believed to be white due to the deterioration of the original pigments. In a way, Daniele Fortuna implements a return to the past through contemporaneity.

"If you look at the whole history of art, there has always been a remaking of something that already existed before; and so, instead of looking for absolute originality, in my opinion we need to focus on what we have (also because anyway the cultural background we have is fantastic and it is to be paid homage to) and make it more contemporary by updating it."

Daniele Fortuna's sculptures for sale online with prices and value on Deodato Arte

If you are interested in the artist, you can find Daniele Fortuna's works for sale online in our website. The works are signed in original by the artist and provided with certificate of authenticity.

If you are interested in knowing about Daniele Fortuna's prices, value or which works will be on display at the Deodato Arte Contemporary Art Gallery, do not hesitate to contact us by sending an e-mail to [email protected].

Register

Register Wishlist

Wishlist Contact Us

Contact Us