Thank you!

Special Projects

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Unmistakable Tony UV

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Kiss Me UV

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Clark

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Peter

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Bruce UV

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Arthur UV

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Harlock UV

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Willy UV

Mr. Savethewall£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 70 cm

-

Unmistakable Albert

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Pablo

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Salvador

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Basquiat

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Banksy

Mr. Savethewall£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 50 cm

-

Unmistakable Lucio

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Madre Teresa

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Marilyn

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Steve Jobs

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Papa Francesco

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable V

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Peppa

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Jesus UV

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Elisabeth UV

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Mary UV

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Michael

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Kobe

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Vale

Mr. Savethewall£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

70 cm x 50 cm

-

Unmistakable Silvio

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Scrooge 2 UV

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Scrooge 1

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Antonio

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Unmistakable Scrooge 3

Mr. Savethewall£1,235.88 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 50 cm

-

Autoritratto

Mr. Savethewall£127.02 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 60 cm

-

Rouge et blanc and green

Mr. Savethewall£75.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 25 cm

-

Kiss me by the windows

Mr. Savethewall£102.99 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 26 cm

-

Life is not so beautiful

Mr. Savethewall£171.65 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 63 cm

-

Let's cut and never give up

Mr. Savethewall£102.99 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 34 cm

-

Surprise me!

Mr. Savethewall£89.25 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 35 cm

-

Queen me!

Mr. Savethewall£127.02 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 60 cm

-

Mr. Savethewall x Zafferano

Mr. Savethewall£205.30 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

11 cm x 38 cm

-

Lasciando Esmeralda

Mr. Savethewall£171.65 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

60 cm x 40 cm

-

Make Earth Green Again

Mr. Savethewall£102.99 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 30 cm

-

We Get it on the Beach

Mr. Savethewall£102.99 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

40 cm x 30 cm

-

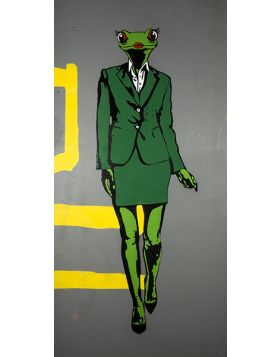

Woman in the Mushroom Kingdom

Mr. Savethewall£75.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

35 cm x 25 cm

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Unmistakable Lupin

Mr. Savethewall£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 70 cm

-

Unmistakable Goemon Ishikawa

Mr. Savethewall£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 70 cm

-

Unmistakable Jigen

Mr. Savethewall£1,510.52 VAT includedVAT included

Products with VAT included show a price calculated with VAT tax, so the additional tax of 22% is already added to the price of these products.

VAT Margin

The products with VAT Margin apply the additional tax of 22% only on the margin, the difference between the price at which the product is purchased and the price at which the same product is resold.

50 cm x 70 cm

-

Register

Register Wishlist

Wishlist Contact Us

Contact Us